Contents:

When you take such a Long Duration mutual fund, you will be required to actively and thoroughly review the performance of these funds from time to time. This will help you be aware of how your fund is doing in the market. The calculation of an investment’s rate of return acquired in the period of an annual year is known as an annualized return. The annualized return is portrayed as the geometric average which shows what you will earn if the annual return is compounded over a while.

In a nutshell, you may use IRR to determine the return from your investments with multiple cash flows. You can use the ClearTax CAGR Calculator to make the right investment decisions. It helps you to determine the annual rate of return of your investments.

Formula to calculate annualized returns:

The securities quoted are exemplary and are not recommendatory. The information mentioned herein above is only for consumption by the client and such material should not be redistributed. Thankfully, you don’t have to get into the hassles of manually calculating these returns. There are various calculators and tools available online that can help you calculate these returns easily.

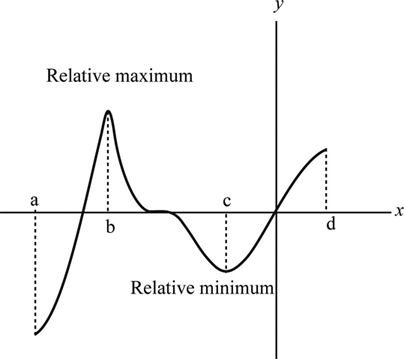

Credit Suisse’s yearbook2023 says that baby boomers enjoyed the best investment returns, in terms of global averages, with annualized real equity returns at 6.7% . Investment Objective – The scheme aims to provide returns close to the total return of stocks as represented by Nifty 50 Index. It is an Exchange Traded Fund which is listed on the capital market segment of the NSE. For example, in the example stated above, the returns on this investment are highly volatile. They are negative after the first year, peak in year 3, and are minuscule in year 4. You may consider calculating the CAGR of your SIP investments in mutual funds.

- Now, the investment and redemption time periods for each investment will be unevenly spaced.

- Taking the same example, suppose you have an investment tenure of two years.

- Moreover, depending on when you are investing and withdrawing, your trailing return can change significantly.

- Mohanty started investing at the age of around 26, by which time the Indian economy had opened up following the liberalization reforms initiated in 1991.

- However, to calculate lumpsum investment with an investment period of over 12 months, you can use Compounded Annual Growth Rate .

It is a useful tool for comparing https://1investing.in/s with different returns earned over multiple time periods. CAGR, or Compound Annual Growth Rate, measures the rate of return of an investment over a certain period, in percentage terms. In other words, CAGR is the imaginary growth rate at which an investment is expected to grow steadily on an annually compounded basis. The absolute return shows how much the investment has grown over the entire period. However, absolute return does not show you the true growth of the investment. You must calculate the CAGR, which shows the annual growth rate of the investment over a while.

For example, you purchased mutual fund units at an NAV of Rs 11. CAGR does not account for the inherent risk of an investment. When it comes to equity investment, risk-adjusted returns are more important than CAGR. You must use Sharpe’s Ratio and Treynor’s Ratio to determine the risk-return reward of the investment. The CAGR calculator shows you the absolute rate of return on the investment.

Measuring performance

You may access it from anywhere, as long as you are connected to the Internet. As we can see, the returns are the same using both the calculations i.e annualized returns & CAGR returns. It means that Mr. X has earned 11.49% annually on an average on his investment. Mr. X made an investment of Rs. 1,50,000 done on 1st January 2020 in ABC mutual fund for 1,500 units. In 2020, Mr. earned a return of 10%, and in 2021, a return of 13%.

Mint spoke to a few Indian investors across the four generations—baby boomers , Generation X , millennials , and Generation Z. For Dividend Distribution Tax, the dividend income from this fund will get added to the income of an investor and taxed according to his/her respective tax slabs. Average return generated by the fund during a specified period. Hence, this states that an investment worth Rs. 1,00,000, after growing at a steady rate of 12.35% every year for 5 years, will finally be worth Rs. 1,79,000. ClearTax offers taxation & financial solutions to individuals, businesses, organizations & chartered accountants in India. ClearTax serves 2.5+ Million happy customers, 20000+ CAs & tax experts & 10000+ businesses across India.

ICICI Prudential Infrastructure Direct Growth

Gradually, he shifted to annualized return funds and has since been a MF investor. While bank FDs offer rates fixed periodically, future market situations will determine returns of debt and equity mutual funds. The main difference between CAGR and absolute returns lies in consideration of the time period. As stated above, one cannot fathom how long it took to earn the absolute return of 79% in the previous example. Whereas, a CAGR return is calculated for a specific time period. Hence, the investment’s 5-year CAGR in the above example is around 12.35%.

Beat the Market Like Zacks: NVIDIA, SoundHound, Reuters in Focus – Nasdaq

Beat the Market Like Zacks: NVIDIA, SoundHound, Reuters in Focus.

Posted: Mon, 27 Mar 2023 11:50:00 GMT [source]

Simply put, multiple years of annual returns do not show the impact of compounding. So you do not get to see the return a fund has accumulated over the period. For instance, a fund could beat its benchmark for most years.

It is a pro forma number which gives you an idea of investment yield on the annually compounded basis. CAGR shows you the geometric mean return of your investments over a time period, also accounting for compounding growth. In simple terms, an investment with a higher CAGR is better as compared to a lower CAGR. If an investment of Rs1000 made 5 years ago is worth Rs.1800 today, while the absolute growth rate is 80%, its CAGR is the average return the investment earned every year.

Top Stock Holdings

On the other hand, point to point is biased by the market conditions prevalent during the period. Please note that by submitting the above mentioned details, you are authorizing us to Call/SMS you even though you may be registered under DND. We collect, retain, and use your contact information for legitimate business purposes only, to contact you and to provide you information & latest updates regarding our products & services. We do not sell or rent your contact information to third parties. Please note that by submitting the above-mentioned details, you are authorizing us to Call/SMS you even though you may be registered under DND. Pay 20% or “var + elm” whichever is higher as upfront margin of the transaction value to trade in cash market segment.

The valuation of the company rose and fell in the five year period. You would find the earnings percentage to be different for each tenure of the investment and CAGR fails to show the accurate earnings percentage over cumulative investment tenures. You may use the CAGR to determine how the investments in your portfolio have performed over some time. To calculate ROI, divide the net profit of an investment by the total cost of the investment and then multiply the result by 100 to get a percentage. A positive ROI means that the returns from the investment are more than the cost of the investment – this means the investment was profitable.

Expert Assisted Services

In the above example, both the funds have delivered a 10% average annual return over the last 10 years, with one fund being more volatile than the other. But only looking at the 10% trailing return would never give you any idea about the volatility in both the fund’s past performance. The formula is quite useful for the situation when you are aware of the returns in dollars, but you are supposed to calculate the exact percentage rate for the entire duration of the investment. In addition to that, the formula makes it easier for investment managers and professional investors to find out the rate of return they could expect from different types of investments in a specific period. Mutual funds return on an investment is reported on an annualized basis.

Use the ClearTax CAGR Calculator to calculate the true value of your investments. You may use CAGR to gauge the performance of different mutual funds to determine the earning potential. CAGR may consider the investment tenure giving you an accurate picture of the earnings from your mutual funds. The CAGR calculator has a formula box where you select the beginning and the ending value of the investment. The CAGR calculator will show you the annual rate of growth of your investment.

That will depend on how long it took to generate such returns—something that a CAGR calculation can help clarify. CAs, experts and businesses can get GST ready with ClearTax GST software & certification course. Our GST Software helps CAs, tax experts & business to manage returns & invoices in an easy manner.

What is 3 year annualized return?

So when you see a 5% under the 3-month column, it means the fund has given 5% in 3 months' time. 12% annualized return in 3 years means 12% return earned every year for the past three years and not 12% total return in 3 years.

In this example, the Rs. 1,00,000 investment has grown to Rs. 1,79,000 over 5 years. You may calculate the final or end value from the CAGR using the reverse CAGR formula. You may consider the following example to get a better understanding. Take a look at the table below which shows the Year and the Revenue of Company XYZ. For example, an investment with a CAGR of 10% is better as compared to an investment with a CAGR of 8%. You may consider CAGR of around 5%-10% in sales revenue to be good for a company.

What does annualized return mean?

An annualized total return is the geometric average amount of money earned by an investment each year over a given time period. The annualized return formula shows what an investor would earn over a period of time if the annual return was compounded.

Each particular investment will offer a different rate of return at a given date of measurement. An annualised rate of return can also be calculated using a percentage value. Compound annual growth rate refers to the compounding of returns over time. It gives investors a preview of an investment’s results, but it doesn’t tell them how volatile it is.

He has some investment in equity linked savings schemes of MFs for tax-saving purpose. Ashish Sharma, 25, a chartered accountant, who has just started working in the financial services space, says he expects 15-20% annualised returns from his long-term investments. “I think such returns should be sustainable over the long-term,” he points out.

Guru Fundamental Report for PFE – Nasdaq

Guru Fundamental Report for PFE.

Posted: Mon, 27 Mar 2023 13:07:00 GMT [source]

CAGR is used to assess the performance of a mutual fund on a standalone basis. XIRR is computed to assess the performance of your investment in the mutual fund. The material/information provided in this Website is for the limited purposes of information only for the investors. The lending transaction is purely between lenders and borrowers at their own discretion, and LenDenClub does not assure loan fulfilment and/or investment returns. Also, the information provided on the platform is verified or checked on the best efforts basis without guaranteeing any accuracy of the data/information verification. LenDenClub will not be responsible for the full or partial loss of the principal and/or interest of lenders’ investment amounts.

What is a good Annualised rate of return?

Most investors would view an average annual rate of return of 10% or more as a good ROI for long-term investments in the stock market.